Nana Otuo Acheampong, the Principal Consultant of Osei Tutu II Centre for Executive Education & Research has warned Ghanaians against supplying banking institutions and other organizations participating in the Credit Reporting System with incorrect personal data (CRS).

The recommendation follows the extension of the list of businesses eligible to participate in Ghana’s Credit Reporting System.

The Credit Reporting System (CRS) is a database created under Act 726 to facilitate the exchange of information about debtors’ credit histories with lenders and other System users.

Telecommunication companies, utility companies, retailers, mobile money operators, fintech, and student loan schemes offered by private or government organizations, among others, have recently been added to the CRS by the Bank of Ghana.

Following the extension of the list, Banking Consultant Nana Otuo Acheampong told Citi Business News that the public has to be informed to avoid falling foul of the credit reporting system’s criteria.

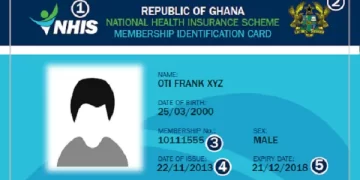

“It is not only the responsibility of the institutions to keep accurate data, consumers and users also have to ensure they provide accurate data. We’ve all registered our mobile money accounts, but you’ll be surprised that 30% to 40% are registered in somebody else’s name, which will prove problematic for them down the line and could lead to lawsuits due to disagreements between institutions and consumers. We need a lot of education on this because this is a new field altogether in our environment and therefore people need to be made aware about what is going to go on,” he said.

Source: CITINEWSROOM