The Social Security and National Insurance Trust (SSNIT) is urging self-employed persons to roll onto the SSNIT scheme to have financial security once they retire.

The Director General of SSNIT, Dr. John Ofori Tenkorang thus says his outfit is embarking on an aggressive strategy of visiting various centres to get more persons within the informal sector to register under SSNIT.

Over the years, many self-employed persons particularly those in the informal sector do not register under the Social Security and National Insurance Trust (SSNIT).

This means that, when they grow old or when unfortunately they become incapacitated, they may not have any financial security and could be vulnerable.

According to SSNIT, as of last year, only 14,000 self-employed persons had registered under SSNIT.

Through vigorous campaigns, the number has increased to about 32,000 persons.

Read Also: 2 babies rescued from lake days after floods

This is however not encouraging enough as SSNIT says around 7 million self-employed Ghanaians fall under that category that are being advised to pay their SSNIT contributions.

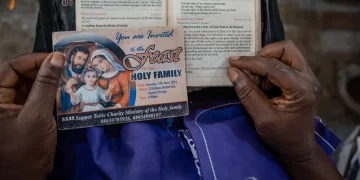

The Director General of SSNIT, Dr. John Ofori Tenkorang speaking on the sidelines of a Self-employment Enrolment Drive in Kumasi, noted that his outfit has adopted a strategy of making self-employed persons understand the essence of paying their SSNIT contributions.

“Unlike the people who are in the formal sector who are working for companies or employers where our law places an obligation on the employer to pay SSNIT on behalf of the workers, these self-employed persons, the law does not make it mandatory for them to join. If they are going to come and join us, it would be because they’ve seen and heard what is in it for them and that is why they will come to us. The first thing we’ve done is to go on an aggressive marketing campaign to explain exactly what it is that we do”.

“That is, we will replace your salary when you achieve the right old age of 60 or if God calls you early, we will pay you the survivors’ benefit to the people who you leave behind or if God forbid, if for some reason you become permanently invalid, and you’re unable to work, we will pay you until death and the last thing being that if you are a member in good standing, and you go for health insurance renewal, you don’t have to pay anything,” he said.

He added that the payment of SSNIT has been made easier as contributors can take advantage of various electronic payment platforms without being charged e-levy.

Dr. John Ofori Tenkorang says SSNIT is seeking to get more self-employed persons by liaising with various associations that those persons belong to, in order to achieve the target of getting five hundred thousand self-employed persons by the end of 2023.

The board chair of SSNIT, Elizabeth Ohene on her part noted that self-employed persons constitute a major part of the population and there is a need to ensure they have financial security once they go on retirement. She thus wants young people to take a serious interest in securing their pension to help enjoy its benefits once they get older.

The Self-Employed Enrollment Drive in Kumasi saw self-employed traders, drivers, farmers, traditional authorities and many others being present. While some are part of those who have registered under SSNIT, many others do not contribute towards the scheme.

Some persons who spoke to Citi News said they did not know persons in the informal sector are eligible to contribute SSNIT dues and enjoy the benefits thereof.

They thus expressed excitement that they can now enrol and start contributing based on the education they have had in it.

SOURCE: CITINEWS