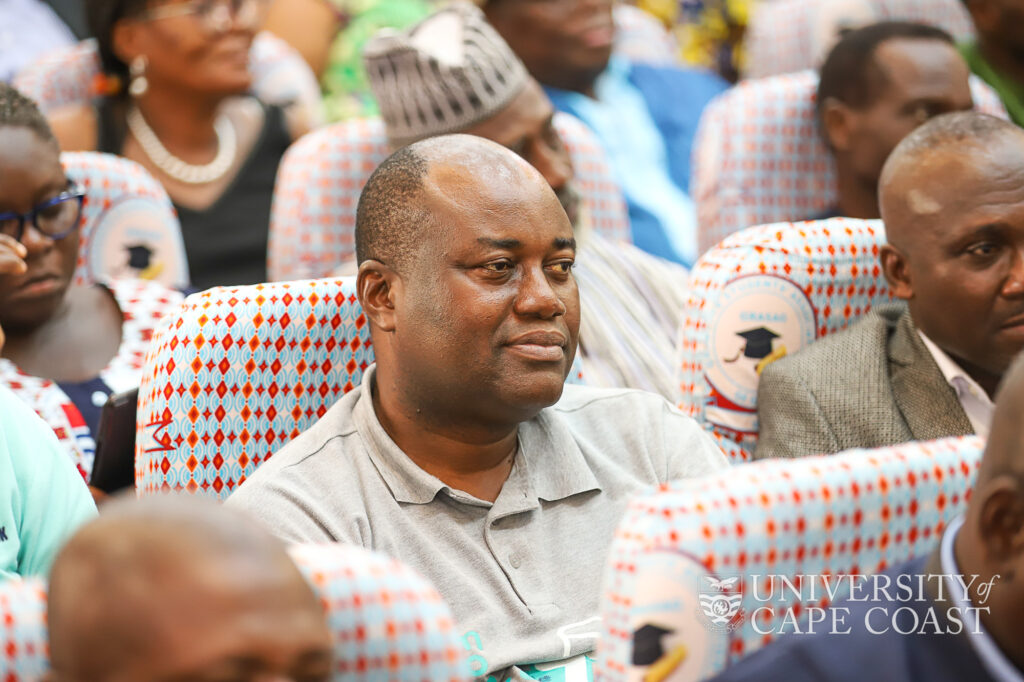

A professor of Finance and Entrepreneurship at the Department of Finance of the School of Business of the University of Cape Coast (UCC), Professor John Gartchie Gatsi has called for the introduction of Islamic banking in Ghana.

He notes that some people do not engage in banking activities for several reasons including their Religious affiliation, and partly because they do not have attractive products in the conventional banking system.

For this reason, Prof. Gartchie Gatsi, also the Dean of the School of Business, says introducing Islamic banking provides an alternative to inclusion, promotes social justice as well as provides a way of sourcing funding to finance infrastructure in the country.

He added that it also diversifies and ensures activities undertaken do not adversely affect the environment, proper debt management, and tends to partner in the delivery of sustainable development goals.

Islamic Banking

Islamic banking is based on Islamic principles in which it is not allowed to pay and receive interest but rather based on profit sharing. Islamic banks focus on generating returns on investments through investment tools that are “Shari’a” complaints.

According to Prof. Gatsi, introducing banks presents several opportunities including promotion of joint ventures, partnerships, and financing infrastructure in a manner that does not burden the state.

He said the other benefits include diversification and promotion of the bond market and deepening the properties market.

Professor John Gartchie Gatsi made the call during his inaugural lecture on Thursday, 29th February 2024 at the University of Cape Coast.

Speaking on the topic: “Islamic Banking Options: Exploring An Inclusive Alternative Or Complement”, Prof. Gatsi indicated that he is not advocating for the substitution of conventional banking with Islamic banking but looking for a means of promoting inclusivity in banking.

He underscored that over 600 billion of Ghana’s debt comes from conventional financial systems which shows the extent to which Ghana has relied on conventional banking.

To this, he notes, “I did say that Islamic banking size is small, but the transactional that it can help finance is huge. So that is the reason why we need to give a trail to Islamic banking to take in the country and other impediments that we have seen in other countries, I do not foresee them because we have largely come out with holidays that reflect Islamic religion”.

The Dean, as a result, revealed that Islamic banking has already been introduced in other countries including Togo, Burkina Faso, Benin, Sudan, and Nigeria, urging that Ghana can learn from these countries.

However, Professor Gatsi proposed that for the introduction of Islamic banking, Ghana needs to review certain Acts of the constitution of Ghana such as Acts 9(30) to reflect Islamic banking activities, Acts 10 (61) to also reflect the views of Islamic insurance, and Acts 9 (29) to accommodate capital market activities by Islamic finance.

Therefore, the way out, he adds is to provide capacity building for judges, lawyers, and court officials to help the state in dealing with issues associated with Islamic banking.

Read more news here

Source: Eric Sekyi/ATLFMNEWS