President John Dramani Mahama has unveiled an ambitious eight-pillar economic blueprint aimed at restoring investor confidence, boosting domestic productivity, and laying the groundwork for long-term fiscal stability.

The strategy, unveiled at the 2025 Ghana CEO Summit in Accra, sets a reform-driven path to consolidate macroeconomic gains while addressing legacy challenges such as rising debt, low investor sentiment, and infrastructure deficits.

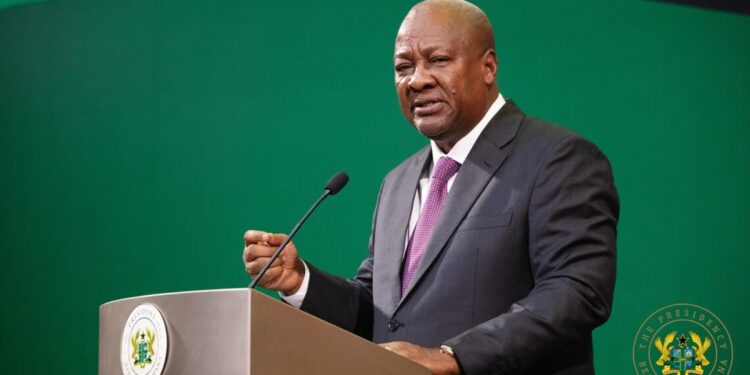

Delivering the keynote address, Mr. Mahama emphasized the urgency of implementing disciplined economic policies and market-focused reforms to reposition Ghana as a competitive investment destination.

1. IMF Programme Completion and Fiscal Discipline

Mahama committed to maintaining strict adherence to fiscal targets under Ghana’s current IMF program, aiming to complete the fourth review by June 2025.

He noted that an orderly exit by 2026 will be followed by policy-support arrangements to entrench fiscal responsibility and investor assurance.

2. Capital Market Re-entry and Investment Reforms

To deepen access to financing, the strategy includes reopening Ghana’s domestic and international capital markets.

Mahama said new borrowing will focus exclusively on self-financing projects led by state agencies, thus avoiding unsustainable debt accumulation.

Partnerships with the IMF, Ghana Stock Exchange, and domestic banks are expected to play a central role in facilitating this shift.

Read Also: Strong investor demand pushes Ghana’s T-bill sales past target by GHS423m

3. Strengthening Fiscal Buffers and Municipal Finance

A key reform will mandate contributions to Ghana’s Sinking and Stabilization Funds to enhance fiscal resilience.

In addition, municipalities will be empowered to issue infrastructure bonds to fund essential projects such as roads, water systems, and education facilities—ushering in a new era of local development financing.

4. Arrears Clearance and Public Investment Rationalisation

Mahama announced that a full audit of government arrears is underway.

The administration intends to clear verified debts transparently while reviewing all new investments for alignment with national priorities and available funding.

5. Financial Management Reforms to Curb Waste

Mahama plans to reactivate a suite of dormant financial reforms including the Treasury Single Account (TSA), real-time budgeting systems, and integrated tax administration to promote transparency, reduce leakages, and enhance public sector efficiency.

6. Export-Led Growth Through EXIM Bank

The Ghana Exim Bank will be repositioned to drive export diversification, particularly in agro-processing, light manufacturing, and SME development.

The initiative is expected to boost foreign exchange inflows and create jobs across key sectors.

7. Ghana as a Regional Trade and Investment Hub

Positioning Ghana as a gateway to West Africa, the plan includes strategic development of trade corridors, ports, financial services, healthcare, and education.

The goal is to fully leverage opportunities under the African Continental Free Trade Area (AfCFTA) and transform Ghana into a logistics and services powerhouse.

8. Infrastructure-Led Growth Through Innovative Financing

Recognizing infrastructure as a key enabler of economic transformation, Mahama reiterated his commitment to resuming stalled projects and launching new ones in transport, energy, housing, and water.

Financing will rely on blended models including PPPs, the Big Push Initiative, and strategic donor and private-sector collaboration.

Mahama closed by urging national consensus around economic transformation, stating, “Ghana’s path to recovery must be underpinned by discipline, innovation, and inclusive growth. This is not a partisan plan—it is a Ghana plan.”

The announcement has been welcomed by a cross-section of industry leaders, economists, and development partners, who say the proposal offers a clear direction amid ongoing economic uncertainties.