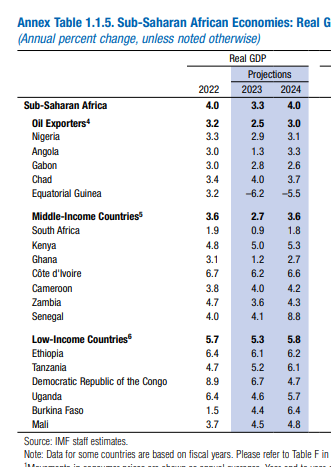

Ghana’s growth rate has been lowered by the International Monetary Fund (IMF) from 1.6% in July 2023 to 1.2%.

This is the second time this year that the Fund has lowered Ghana’s GDP growth rate.

In its World Economic Outlook (WEO) Report in April 2023, the Fund forecasted a 2.8% growth rate for Ghana.

The country’s growth rate for this year has been somewhat cut to 1.5%, according to the World Bank’s October 2023 Africa Pulse Report.

The IMF named lower government spending on infrastructure and investments as well as fiscal slippages brought on by high debt levels and a budget deficit as major culprits.

Read Also: UG to dismiss students with GPA below 1.00

The Fund forecasts a 2.7% increase of the Ghanaian economy in 2024, much below the pre-pandemic average of 5%.

Global economy recovers slowly

Meanwhile, the world economy is slowly recovering from the pandemic, Russia’s invasion of Ukraine, and the cost-of-living problem.

In retrospect, the tenacity has been astounding.

“Despite the disruption in energy and food markets caused by the war, and the unprecedented tightening of global monetary conditions to combat decades-high inflation, the global economy has slowed, but not stalled. Yet growth remains slow and uneven, with growing global divergences. The global economy is limping along, not sprinting”, the report stated.

Global GDP will slow from 3.5% in 2022 to 3.0 this year and 2.9% the next year, which is 0.1 percentage point less than what we predicted in July.

This is still much below the historical norm.

Risks

According to the research, while some of the extreme risks, such as serious banking instability, have subsided since April 2023, the balance remains skewed to the downside.

“First, the real estate crisis could deepen further in China, an important risk for the global economy. The policy challenge is complex. Restoring confidence requires promptly restructuring struggling property developers, preserving financial stability, and addressing the strains in local public finance”, it stated.

Western sanctions on Russian crude oil exports have had mixed effects: export flows of Russian oil have remained fairly steady, and its price discount relative to Brent oil has shrunk over time—Russian oil is trading above the $60 price cap imposed by the Group of Seven (G7) countries—as the size of the non-Western-aligned oil tanker fleet carrying Russian oil has increased, and as Russia appears to have set up its own maritime insurance

Second, when geopolitical conflicts and disruptions linked to climate change recur, commodity prices might become more unpredictable.

Due to ongoing production limits from OPEC+ (the Organisation of Petroleum Exporting Countries plus selected nonmembers), oil prices have increased by almost 25% since June.

Food costs are still high and might rise more if the conflict in Ukraine escalates, which would be extremely difficult for many low-income countries. Of course, this puts the disinflationary policy at serious danger.

SOURCE: CITINEWS