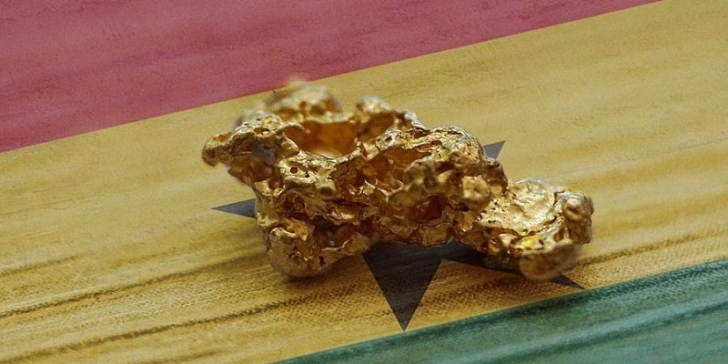

Ghana’s gold reserves have surpassed GH₵46.4 billion in value, as the Bank of Ghana (BoG) deepens its strategic pivot towards precious metals to strengthen the economy and safeguard the cedi amid global uncertainty.

In its latest disclosure, the central bank revealed that as of April 30, 2025, the country’s gold holdings reached 31.37 tonnes, equivalent to just over one million ounces (1,008,837.07 oz), based on the standard conversion of 32,150.7 ounces per metric tonne. With the international spot price rising to GH₵46,086.32 per ounce, the total value of Ghana’s gold assets has climbed to GH₵46.44 billion.

This marks a significant leap from just two years ago, when the BoG’s reserves stood at 8.78 tonnes. The increase reflects the aggressive implementation of the “Gold for Reserves” programme, a government-backed initiative aimed at reducing reliance on foreign currencies, particularly the US dollar, and bolstering fiscal resilience.

The central bank’s accumulation strategy aligns with Ghana’s broader macroeconomic framework to insulate the economy from external shocks. With inflationary pressures, rising US tariffs, and geopolitical tensions driving up global demand for gold, Ghana — Africa’s leading gold producer — is leveraging its mining dominance to fortify national reserves.

Read Also: Supreme court dismisses injunction, affirms process in Chief Justice suspension case

According to financial analysts, this strategic stockpiling enhances the country’s ability to manage exchange rate volatility and support monetary stability. It also positions the BoG to better navigate international trade dynamics and balance-of-payment pressures.

While the Bank of Ghana has not indicated a change in its gold acquisition trajectory, the sustained rally in global bullion markets may incentivise continued accumulation in the months ahead.

Ghana’s enhanced gold reserves not only improve its creditworthiness and investor confidence but also signal a growing shift among emerging economies toward asset diversification and sovereign wealth protection through tangible commodities.