Africa’s top digital banking platforms typically come from high-growth, populous markets like Nigeria, South Africa, and Egypt. But Affinity Africa, an upstart from Ghana, wants to join the conversation. The startup has raised $8 million in seed funding to expand its financial products further across the country, where mobile money is the dominant financial tool.

While mobile money has become the go-to for financial transactions, the traditional banking sector in Ghana and Africa as a whole remains highly profitable. Since the pandemic, banks in Ghana have recorded growth with an after-tax return on equity (RoE) that exceeds the global average.

But while inefficiencies like high operating costs, a lot of in-person documentation, and lengthy onboarding delays have left millions underserved, these gains mainly come from fees.

According to World Bank data, over 60% of persons in Africa do not have access to formal financial services, and less than 10% of enterprises have credit available to them. The need for digital banking alternatives like Affinity, which provide a more affordable and inclusive model, has increased as a result of this widening divide.

According to Tarek Mouganie, the company’s founder and CEO, Affinity has onboarded more than 50,000 consumers since its October launch. Notably, more than 60% of its users are women employed in the unorganized sector, and 65% of them had never used formal banking products previously.

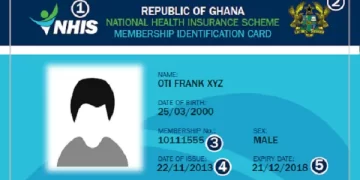

Why, then, has it taken so long for an upstart in digital banking to become so popular in Ghana? Strict financial laws in the nation are a major factor. Fintechs find it challenging to enter Ghana because microfinance licenses are hard to obtain, costly, and time-consuming, in contrast to neighboring Nigeria, where digital banks can operate with ease.

Mouganie told TechCrunch, “Ghana’s regulator is focused on protecting consumers, especially in deposit-taking institutions.” “As a microfinance organization, we had to demonstrate effective risk management, break even, and match our objectives with the government’s objective of banking the unbanked. In the end, they were persuaded by the way our digital platform cuts banking costs and friction for both people and micro, small, and medium-sized businesses (MSMEs).

From investment banking to fintech disruptor

Before beginning his career in academics and banking, Mouganie, who hails from a fourth-generation Ghanaian family of Lebanese heritage, studied in the United Kingdom and obtained a bachelor’s and doctoral degree. Later on, he served as a director at the $160 billion international investment fund Man Group. He worked on significant initial public offerings (IPOs) there, such as Visa and Compartamos, the biggest microfinance company in Latin America.

Ten years after returning to Ghana, Mouganie set out to address the issue of financial inclusion in Africa, which is frequently mentioned in international consultant reports.

“Today, people are still quoting figures like Africa’s $331 billion credit gap,” he remarked. “Really, nothing has changed. That prompted me to get fixated on creating a full-fledged retail bank for MSMEs that is suited for the majority of people in Africa, much like Santander, Lloyds, or Chase Bank do in Europe and the US.

In 2020, he raised $2 million to buy a microfinance bank with a group of friends and relatives. He says these included money from the sale of his home in London. The organization acted as a test site for its current banking solutions after being granted a savings and loans license, the first of its sort in more than a decade.

ICYMT: Mahama Vows Tough Action on Corruption as ORAL Committee Submits Final Report

In order to upgrade this license, Affinity secured an extra $3 million in a pre-seed round by 2022. The fintech successfully debuted its app last October after months of covert testing and approval from the nation’s top bank, Bank of Ghana.

In Africa, microbusinesses and individuals are frequently interchangeable, and Ghanaian fintech caters to both. The technology instantly starts credit-scoring users based on their transaction history, and customers receive free savings and current accounts with no transaction restrictions.

Affinity offers credit lines with interest rates ranging from 3 to 7% per month after a few months of use. With a non-performing loan (NPL) rate of 3% and instant loans expanding 30% month over month, the Accra-based fintech has disbursed over $15 million in loans across a variety of products.

A hybrid approach: digital banking with a physical touch

Additionally, customers can access other banking services like savings, payments, investments, and transfers to banks and mobile money wallets. Last month, mobile money top-ups accounted for 89% of deposit inflows, which has increased 54% month-over-month since its launch, while bank transfers accounted for the remaining 11%. Over 90% of Affinity’s revenue comes from loans, with the remaining 10% coming from fees and commissions on services like utility bill and internet payments via USSD and the mobile app. Over the last six months, Affinity’s revenue has increased 37% month-over-month, according to Mouganie.

Affinity, like many digital banks in Africa, uses its agent network to combine offline touchpoints with online banking; approximately 30 agents meet small companies in person, onboard them to the app, and help close the trust gap for new users of digital banking.

SOURCE: TECH CRUNCH