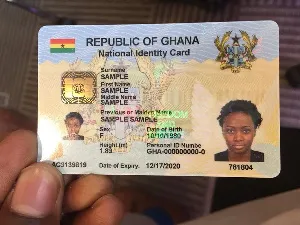

The Africa Centre for Digital Transformation (ACDT) is advocating for the Ghana Card to be fully integrated into the country’s financial system, allowing it to function as an ATM card.

In a statement, ACDT called on the National Identification Authority (NIA), the Bank of Ghana (BoG), and financial institutions to accelerate efforts to link the Ghana Card to banking transactions.

The organisation highlighted that enabling the Ghana Card for ATM withdrawals, transfers, and payments would enhance financial inclusion, security, and convenience for Ghanaians.

Read Also: GWCL pledges quick resolution to ongoing water shortages

To make this possible, ACDT proposed key steps, including linking all bank accounts to the Ghana Card via a secure national database and upgrading ATM and POS systems to recognise the card’s embedded chip.

It also recommended biometric authentication and PIN verification for added security.

Additionally, ACDT urged financial regulators to establish clear legal and cybersecurity frameworks to protect users from fraud.

The group also emphasised the need for a nationwide public education campaign to guide Ghanaians on how to use the Ghana Card for financial transactions.

“We call on the NIA, Bank of Ghana, and financial institutions to prioritise this initiative and ensure that millions of Ghanaians can seamlessly access banking services with their Ghana Card,” ACDT stated.