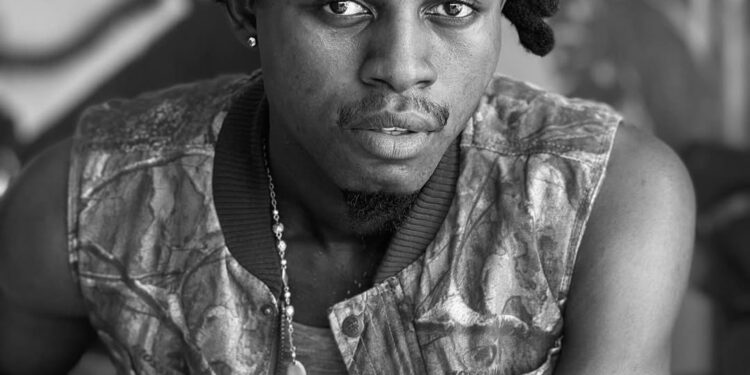

Ghanaian rapper Kweku Flick shares how he outsmarted a fraudster in Kumasi after being scammed with fake phone tiles, igniting discussions on street justice and self-defense tactics.

During an interview on the Okukuseku Talk Show with actress Emelia Brobbey, Flick recounted a surprising experience from his teenage years involving a phone scam and his daring act of retaliation.

The “Money” hitmaker recalled being duped while in his final year of Junior High School (JHS 3) in Kumasi’s busy Adum PZ area.

Scammed with a Fake Phone

Flick explained that it was his first visit to Adum PZ to buy shoes when a stranger approached him with an enticing phone deal.

“Someone came up to me, claiming to be in a hurry and urging me to buy the phone quickly. I traded my phone along with some of my school fees,” he said.

To his disappointment, when he opened the package later, he found it contained glued floor tiles instead of a phone.

ICYMT: Slot Plays Down Liverpool Worries

“By the time I finally opened it, I realized I had been tricked,” he revealed.

Determined to get his revenge, Flick returned to the area, hoping to confront the scammer or find another one in action.

“I saw another guy doing the same thing. He approached me with a similar story, but this time I was ready. I showed interest in buying the phone and asked him for the PIN to unlock it,” he recounted.

Once he accessed the phone, Flick quickly sought assistance.

“I noticed an older man approaching and ran to him, claiming the seller was a thief trying to steal my phone,” he continued.

When the man asked for proof of ownership, Flick easily unlocked the phone. The older man restrained the alleged fraudster, allowing Flick to make his escape.

“I did, and the man held the seller while I ran. They chased me from Adum PZ to the Kumasi Cultural Centre, but I managed to get away,” he added with a chuckle.

Though the incident was traumatic at the time, it remains a memorable story from the artist’s youth, illustrating both the risks of street scams and the cleverness he demonstrated even as a teenager.

SOURCE: PULSE GHANA