Finance Minister, Ken Ofori-Atta has revealed that his ministry has formally written to the Pensioners Bondholders Forum about the exemption of pensioners who did not participate in submitting their old bonds.

According to him, pensioners who did not participate in submitting their old bonds for new ones under the Domestic Debt Exchange Programme (DDEP) have been fully exempted.

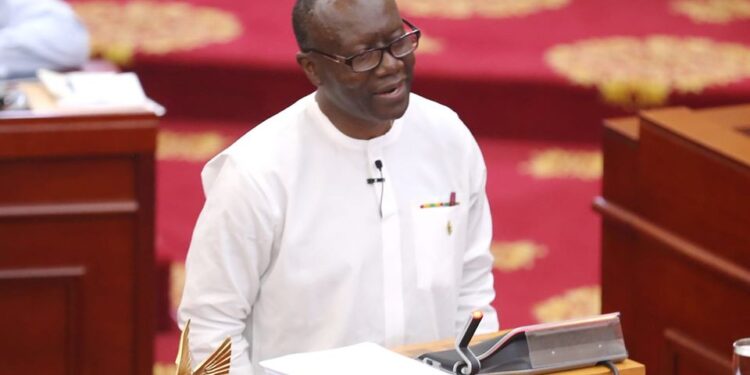

He made this known on the floor of parliament on Thursday, February 16 while briefing parliament over the controversial Domestic Debt Exchange Programme.

There have been several protests over the past weeks by some senior citizens following the announcement by the finance minister over the debt restructuring programme which they believe will have an effect on their finances.

In an earlier statement, the ministry of finance indicated that participating in the debt restructuring was voluntary, therefore, pensioners could decide whether to participate or not.

However, the aggrieved pensioners insist that the Minister makes it formal and include that their bonds are exempted from the debt restructuring programme.

Addressing parliament yesterday, Mr. Ofori-Atta reiterated that after Wednesday’s engagement with pensioners during their picketing at the ministry, pensioners who did not partake in the exchange have been excluded from the program.

“Mr. Speaker, in seeking to understand the concerns of our Senior Citizens, I have met with them on three occasions. The most recent was yesterday 15th February 2022, where I explained the terms of the new bonds…I subsequently wrote to their Convener, letting him know that all pensioners who did not participate in the exchange are exempted and therefore there will be no need for our Senior Citizens to picket at the Finance Ministry”

He notes that government remains committed to the well-being and dignity of Senior Citizens and Pensioners however their grievances have been of great concern to him.

“Indeed, it has personally caused me great distress as a number of them have picketed at the premises of the Ministry of Finance since Monday, 6th February 2023. As I have already indicated in my Press Release dated 14th February 2023, Government will honour their coupon payments and maturing principals, like all Government bonds, in line with Government’s Fiscal commitments.”

Touching on the other measures to help the country recover from the financial gap, Ken Ofori Atta appealed to the legislators to approve all outstanding revenue bills before parliament and to support government’s financial request.

He said these efforts will be greatly enhanced if the income tax amendment bill, the excise duty and excise tax stamp amendment bill as well as the growth and sustainability levy bill tabled before parliament, could be prioritized and passed.

According to him, the passage of these bills will enable government to complete four of the five agreed prior actions in the staff-level agreement.

He, therefore, entreated the House to prioritize the approval of the outstanding revenue bills in the various concessional facilities.

“Mr. Speaker, as international and domestic bond markets, are shut for the financial government programs, we are relying on treasury bills and concessional loans as the primary sources of financing for the 2023 budget. We therefore, Mr. Speaker, call on this House to support the government finance and request to ensure a smooth recovery from these economic challenges” he said.

Read more news here

Source: Eric Sekyi/ATLFMNEWS