The School of Business UCC has held the second edition of its webinar series. This featured some experts in the financial sector who contributed to a discussion on the topic Coronavirus Pandemic Tax Relief and Financial Reporting Implications.

Government has granted a number of relief packages to businesses and some public sector workers in Ghana as interventions following the coronavirus pandemic which has devastated various sectors of the economy.

These include additional emoluments for health workers, extra allowances to frontline health workers, waiver of income tax on withdrawals from tier three provident funds and the granting of 600 million Cedis stimulus package for SMEs.

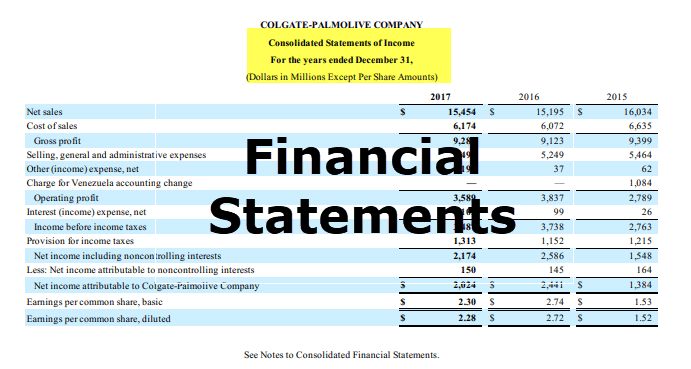

In as much as these supports from government have come to cushion businesses within the period of the pandemic, Dr. George Tackie, head of the Department of Accounting at the School of Business UCC contributing to the webinar said these interventions would be subjected to the usual auditing by the Ghana Revenue Authority- GRA. In this regard, financial reports as mandated by the Company act 2019, Act 992 would be required.

“The law states a director of a company stands in a fiducial relationship towards the company and shall observe the utmost good faith towards the company in the transaction with or on behalf of the company. Therefore the directors or management of companies are expected to stand in that trust and confident relationship with their stakeholders, to provide their financial report in good faith.”

Dr. Tackie added that ” in as much as they are required as directors of companies to make the necessary adjustment based on the impact of the Covid 19 on their business operations and to report same, they cannot provide as it were falsified information because of the pandemic.”

Emphasizing that,” the 2020 financial statement would be audited.”

Relatedly, Managing Partner, Ikern &Associates; a private accounting firm in Accra, Dr. Isaac Nyame advised business managers to take interest in providing the necessary details and supporting documents in their financial statements since tax auditors would be interested in that.

“The GRA is interested in taking every penny of the tax liability, they would want to look at the trial balance which shows all the details of all transactions that have happened across the year. “

He said the supporting documents would allow tax payers provide evidence of which the basis of the financial statement was prepared to prevent tax auditors from disallowing certain expenses.

Related: Explore Policies beyond Stimulus Package to Support SMEs- Government advised

Dr. Nyame cautioned business managers over their illiteracy in terms of tax and what confronts their businesses saying,” they mustn’t leave everything to either the accountants or tax consultants “.

He said managing directors must take interest in how these things are assessed and get some reasonable education, to be able to defend their position when there is dispute over tax liability.

Contributing on the same platform, Dr. Abdallah Ali Nakyea, Managing Partner of Ali-Nakyea & Associates; a private tax firm in Accra, believes Small and Medium Scale enterprises, have a lot to gain from tax reliefs. However, it would require education and understanding of the law to reduce their tax exposure.

You can read this too: Teach children financial literacy to improve financial socialization – Prof Megan McCoy

“I think that the challenge of the SMEs, is knowing exactly what is in the law for them and that is where I expect a lot of tax education because the key to reducing your tax exposure is keeping of records.”

Dr. Nakyea in his submission cited situations where SMEs are unconcerned about the little details of their businesses, “there are some who may not even appreciate why they must take receipts for certain expenditure but they go a long way to help, you may have taken a loan from the bank if there are interest elements how are you even monitoring the interest payments, how are you even taking advantage of all these’ he quizzed.

He again suggested that for those who are self-employed they stand the chance of benefiting from not only their personal income tax relief but also from capital allowances on their assets.

The School of Business webinar series focuses on the five academic departments of the school; Accounting, Finance, Management, Human Resource Management, Procurement and supply chain, and the Centre for entrepreneurship and small enterprise development. The next session, the third in the series, would tackle, Coronavirus Pandemic, implications for entrepreneurship and enterprise development.

Source: Joseph Kobina Amuah/ATLFMNEWS