In order to decrease panic withdrawals at some mobile money vending stations, the Mobile Money Agents Association of Ghana asks the government to boost public education on the electronic transfer levy.

According to the association’s General Secretary, Evans Otumfuor, the public should be aware that the deduction of the tax has no effect on some transactions.

Mr. Otumfuor believes the government should do more to educate the people about the e-levy.

Read Also: A$AP Rocky proposes to Rihanna in ‘D.M.B.’ music video

“Most Ghanaians are still ignorant about how the deductions will be made, and this is affecting mobile money vendors across the country. There have been a lot of panic withdrawals these past few weeks. We need more education on the tax. We are sure that when this is done, panic withdrawals will reduce.”

Evans Otumfour also urged mobile money agents to continue operating in the expectation that all issues arising from the new tax policy will be resolved shortly.

“The E-Levy has come to stay and there is absolutely nothing we can do about it. We can only encourage our members to continue their business activities. We are hopeful that with time, Ghanaians will accept the tax and things will go back to normal.”

Despite considerable disapproval of the tax idea, the government began implementing the contentious charge on May 1, 2022.

Following repeated demonstrations sponsored by the opposition party, its Members of Parliament, and several civil society organisations, the levy was cut from 1.75 percent to 1.5 percent.

The government had anticipated to earn around GH7 billion from the 1.5 percent charge on mobile money and other electronic transactions, but that amount was recently lowered downward to roughly GH4 billion.

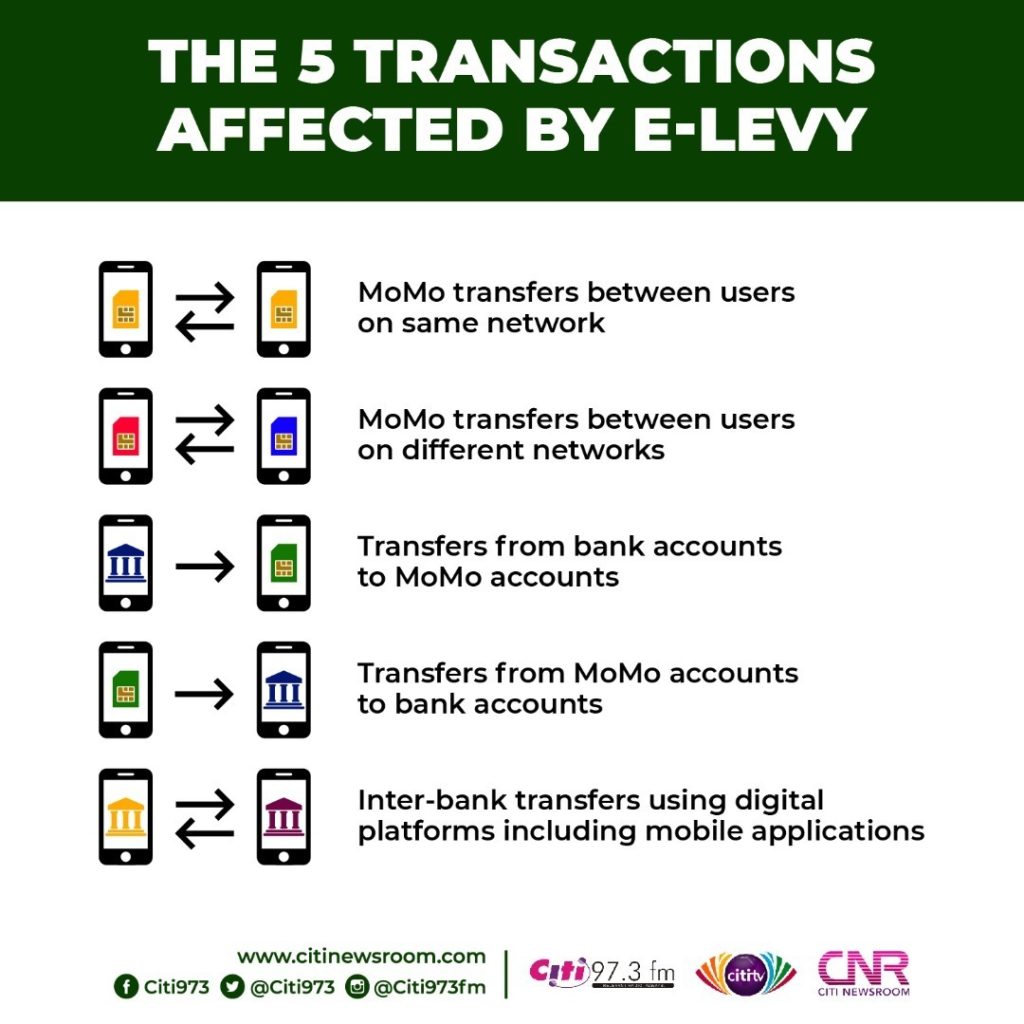

Transactions affected by E-Levy

The E-levy applies to transfers between two different users on the same mobile network (for example, AirtelTigo to AirtelTigo), transfers between users on different mobile networks (for example, AirtelTigo to MTN), transfers from bank accounts to mobile money accounts, transfers from mobile money accounts to banks, and interbank transfers via mobile applications or other digital platforms.

SOURCE: CITINEWSROOM