The Importers and Exporters Association of Ghana says the public should expect a hike in the prices of goods and services in the next couple of days following the government’s implementation of new taxes.

As part of the government’s efforts to revive the economy amidst the Covid-19 pandemic, it introduced some new taxes including, a 1% COVID-19 health recovery levy, energy sector recovery levy, among others.

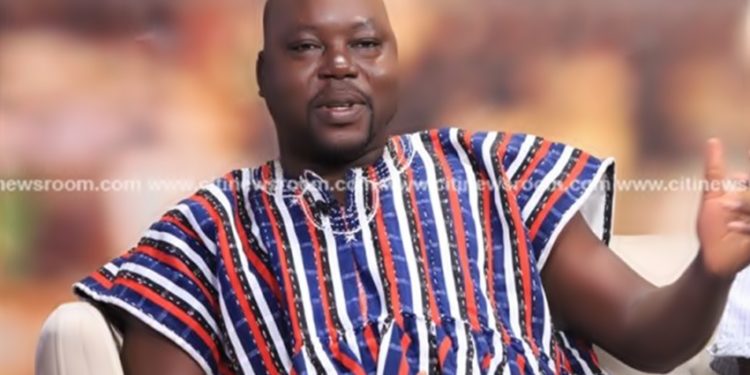

According to the Executive Secretary of the Importers and Exporters Association Ghana, Samson Asaki Awingobit, consumers should brace themselves to pay more because “as a responsible association, we are very much aware that customers are people we have to build a good relationship with. In doing so, it is important that we alert consumers and potential buyers that come first May, what you used to buy GHS1 will shoot up. This is not because the importer is enjoying it, but it’s because the government has come out to tell us that they needed these monies in order for them to fight the Covid-19 pandemic, or for the cleaning of the financial service institutions etc.”

The Ghana Revenue Authority earlier indicated that it would commence implementation of the new taxes effective May 1st this year.

These new taxes are as a result of the imposition of an Energy Sector Recovery Levy of GHS 20 pesewas per litre of petrol/diesel and 18 pesewas per kg on Liquefied Petroleum Gas (LPG) and a Sanitation and Pollution Levy of GHS10 pesewas per litre of petrol and diesel.

Also taking effect is the COVID-19 Health Recovery Levy Act, 2021 (Act 1068) and the Energy Sector Levy (Amendment) Act, 2021 (Act 1064).

Already, some transport associations like the Committed Drivers Association, say they will pass on the taxes to passengers by increasing fares.

Read Also: National Security busts fake currency gang involved in over $5m scheme at airport

SOURCE: CITINEWSROOM