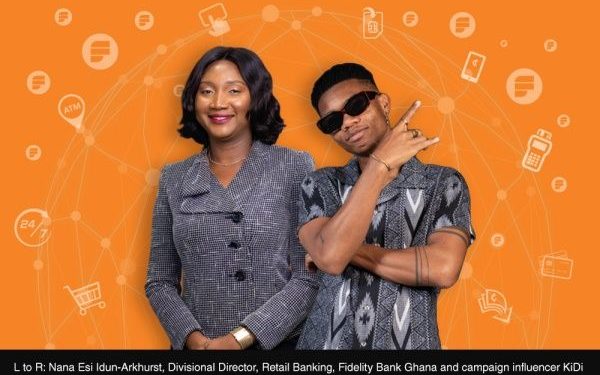

KiDi, a highlife and afro-beats singer-songwriter from Ghana, has been appointed as the brand-influencer for Fidelity Bank Ghana’s creative suite of digital products and services.

This took place at the unveiling of the Digital Banking Initiative on Monday.

The Fidelity Digital Banking Campaign seeks to strengthen the importance and protection of digital financial transactions, especially against the backdrop of COVID-19.

A statement released by the Bank and copied to the Ghana News Agency stated, “Fidelity’s innovative portfolio of digital products includes such amazing products like the Fidelity Mobile App, Fidelity Online Banking, Fidelity USSD, Fidelity’s online account opening portal, Fidelity’s POS system and of course, Kukua, Fidelity’s WhatsApp Banking Assistant, among many others”.

The award-winning and talented singer, known in real life as Dennis Nana Dwamena, said, “I am honored to associate with Fidelity Bank, a bank that transforms the lives of its customers with its digital products and services. I’m eager to spread the word about the multiple advantages of digital banking products and services, as I can testify that they make my life simpler.”

Speaking on the relationship with KiDi, Nana Esi Idun-Arkhurst, Divisional Director, Retail Banking at Fidelity Bank Ghana, said, “KiDi is the right inspiring individual with dynamism and cross-generational appeal to support the Bank’s creative digital range of products and services.

“The energy and ambition that he reflects is an incredible match with our digital initiatives and our commitment to excellence.

“Digitizing our banking processes is a core component of our corporate plan as we aim to keep consumers satisfied in their day-to-day financial transactions. We will strive to deploy revolutionary technologies to fulfill the changing demands of all our consumer segments.”

The Digital Banking Initiative, which will continue for the next several months, stresses Fidelity’s responsibility for the welfare of its consumers in this age of COVID-19.

Read Also: C/R: Two district to benefit from phase one Covid-19 vaccination

“Indeed, the best way to adhere to the COVID-19 protocols is to use digital banking products and services,” Nana Esi said.

“Fidelity digital goods and services have the required ease and comfort to allow consumers to work from anywhere and at any time without needing to travel to any branch physically.

“The public can use ‘Kukua’, Fidelity’s 24-hour WhatsApp Banking Assistant, for fund transfers, airtime top up, exchange rate checks, mini statement reviews, account balance checks and ATM and branch location; all in real time.”

The statement claimed that consumers may also use the updated Fidelity Mobile App to make purchases such as wallet and reverse transaction accounts, service and cashless payments utilizing Fidelity GhQR as well as foreign transactions, FX sales, travel notices in addition to local account transfers.

“Fidelity Bank’s Digital Banking Campaign is testament to the Bank’s ‘Together We’re More’ brand promise that views success as a collaborative effort between itself, customers and the general public.

Truly, Fidelity has proved that by working together with its clients, they can do better things together.”

In a little over a decade, Fidelity Bank Ghana has grown from a discount house to a Tier One Bank and is now the largest privately-owned Ghanaian Bank.

The bank currently services its clients in 75 branches throughout Ghana and is a pioneer in the digital banking movement.

Fidelity Bank also revolutionised the agency banking space in Ghana with more than 4,000 agents across the country.

The bank has two branches, Fidelity Asia Bank Limited, a wholly owned company in Malaysia and Fidelity Securities Limited.

Over a short span of time, Fidelity Bank has become a household name in Ghana by embracing a customer-centric ethos and continuously delivering on the pledge of creating a difference in the lives of all stakeholders.

SOURCE: ATLFMONLINE